Advertisement

Strength. Scale. Liquidity. All in one trade.

With SPY, you get the full power of the S&P 500® in a single trade—plus unmatched liquidity to help you stay flexible, focused, and ready for what’s next.

Adtrax: 8559940.1.1.AM.RTL SPD004278

Expiration: 11/30/26

Very rarely do I pick up a paper version of the WSJ, but I am off the grid in Jamaica, VT and the wi-fi is spotty so I grabbed one from the best store in the world, West River Provisions.

At the back of the paper I found all the stocks making new 52-week highs and went through each of them.

JC reminded me of the importance of this exercise on The Morning Show last week, so let’s just say I felt inspired.

Going through these stocks gave me the idea, “how did the stocks that were working at the end of 2024 then perform in 2025?”

And boom. Two chart ideas. Sometimes that’s how it happens.

Both are plotted below.

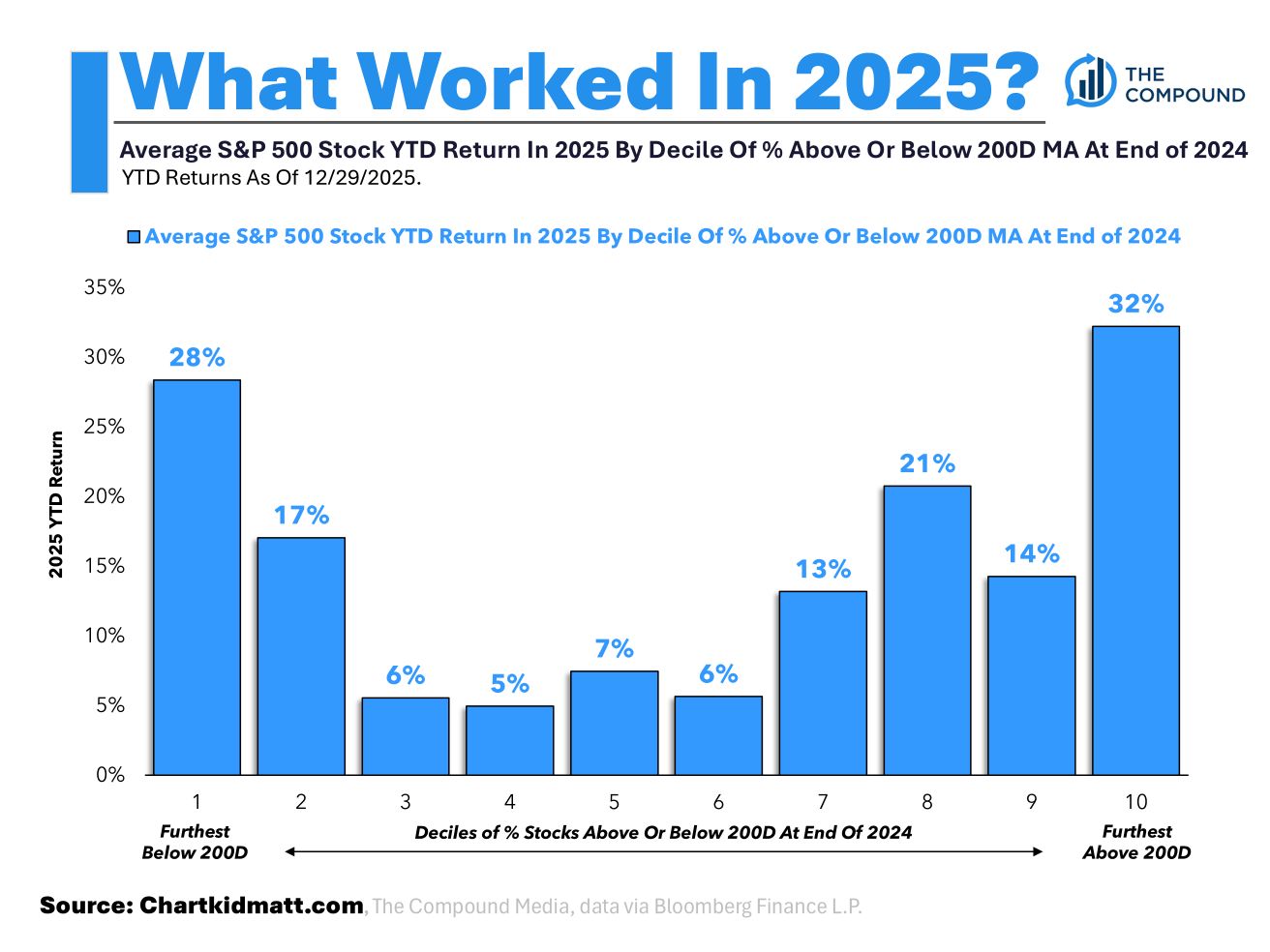

In the first chart, the X-axis shows deciles of S&P 500 stocks based on how far above or below their 200-day moving average they were at the end of 2024. The Y-axis shows the average return for each group in 2025.

The stocks that were furthest above their 200-day moving averages at the end of 2024 went on to perform the best in 2025.

Interestingly, the second strongest group was the stocks that were furthest below their moving averages. Many beaten down names at the end of 2024 rallied in 2025.

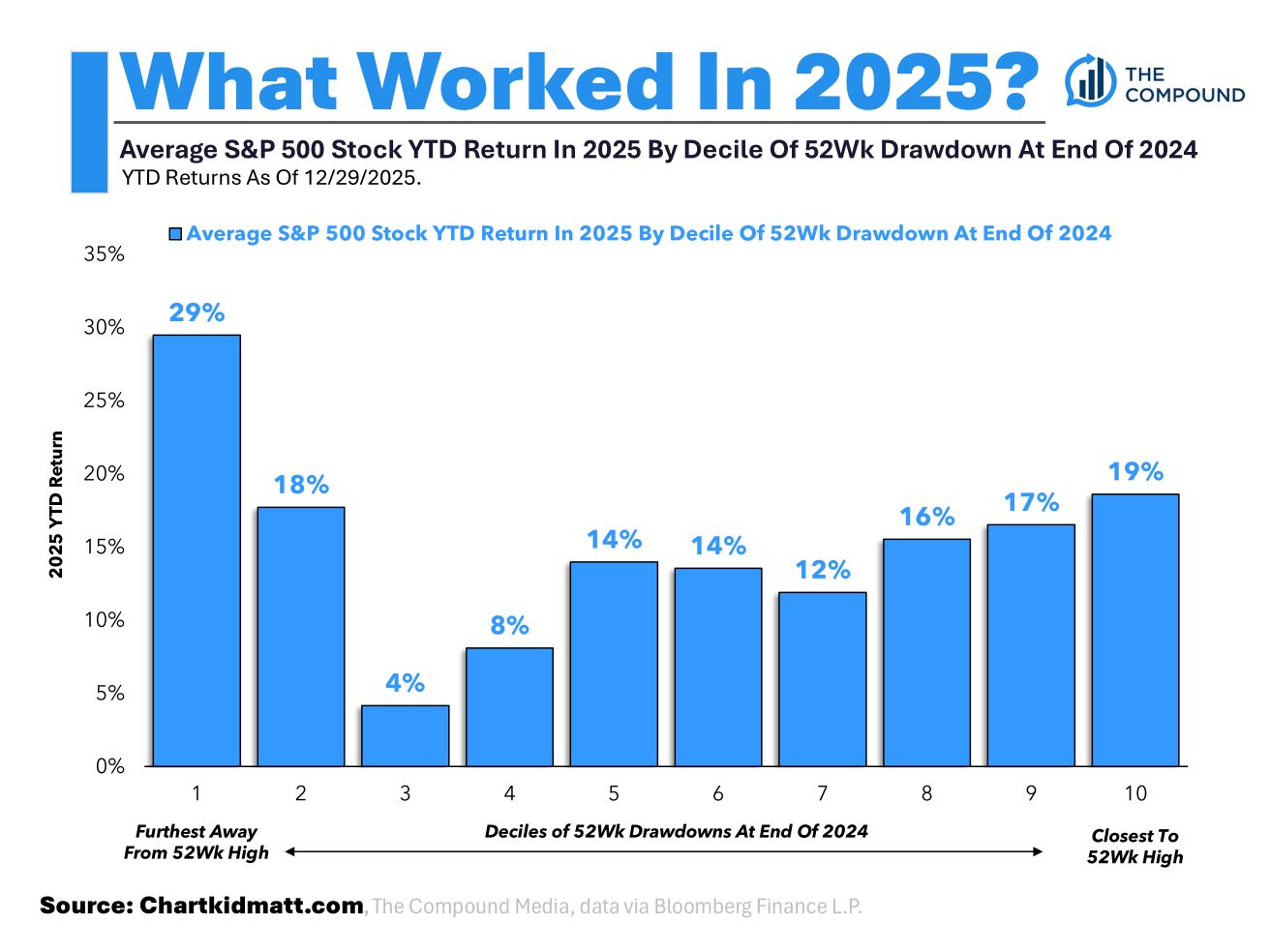

I also looked at deciles of stocks that were furthest away vs closest to 52 week highs at the end of 2024 vs their actual returns in 2025.

The stocks that had been the most beaten down at the end of 2024 delivered the strongest returns in 2025.

The second best performers were stocks that entered 2025 closest to their 52-week highs.

Taken together, these charts show that 2025 rewarded both momentum and mean reversion. Stocks that entered the year already working tended to keep working, while some of the most beaten-down names staged meaningful rebounds.

That’s all for today. Thank you as always for reading and have an amazing holiday season/happy new year.