Advertisement

Looking for a simpler way to invest Foolishly?

Motley Fool Asset Management factor ETFs give you exposure to 100 Foolish stock picks in a single trade. Our three newest funds pursue Innovative Growth (MFIG), Value (MFVL), and Momentum (MFMO).

The S&P 500 just closed at its highest level ever.

Let me put that into perspective for you.

There have been 24,365 trading days since 12/30/1927.

That’s nearly 100 years of data.

And today, January 27th, 2026, saw the highest closing price of them all.

Now, as I show you this chart, the voice inside your head may begin to chime in and remind you of everything that might go wrong from here.

After all, it’s been whispering to you that the AI spending is circular and the debt burden is too much for the economy to handle and the bank earnings were underwhelming and the tariff talks are back and the Mag 7 aren’t pulling their weight and the government might actually shut down again and… I’ll stop. You get the point.

I want you to know that you are not alone. The voice is there for me too.

Unfortunately, there is no way to silence it.

It does not answer to the arithmetic you run in a spreadsheet telling it that "74% of the time, the S&P 500 is positive over one year holding periods.”

It will crumple up your excel spreadsheet, throw it in the trash, and yell back “but what about the other 26% of the time?”

The voice is never there to reassure you that “everything is going to be okay.”

Instead, its sole purpose is to remind you that “danger is lurking around the corner, even if you can’t see it today.”

I am here to assure you that as seductive as the voice might be, especially at all time highs, it is not a profitable one to be listening to.

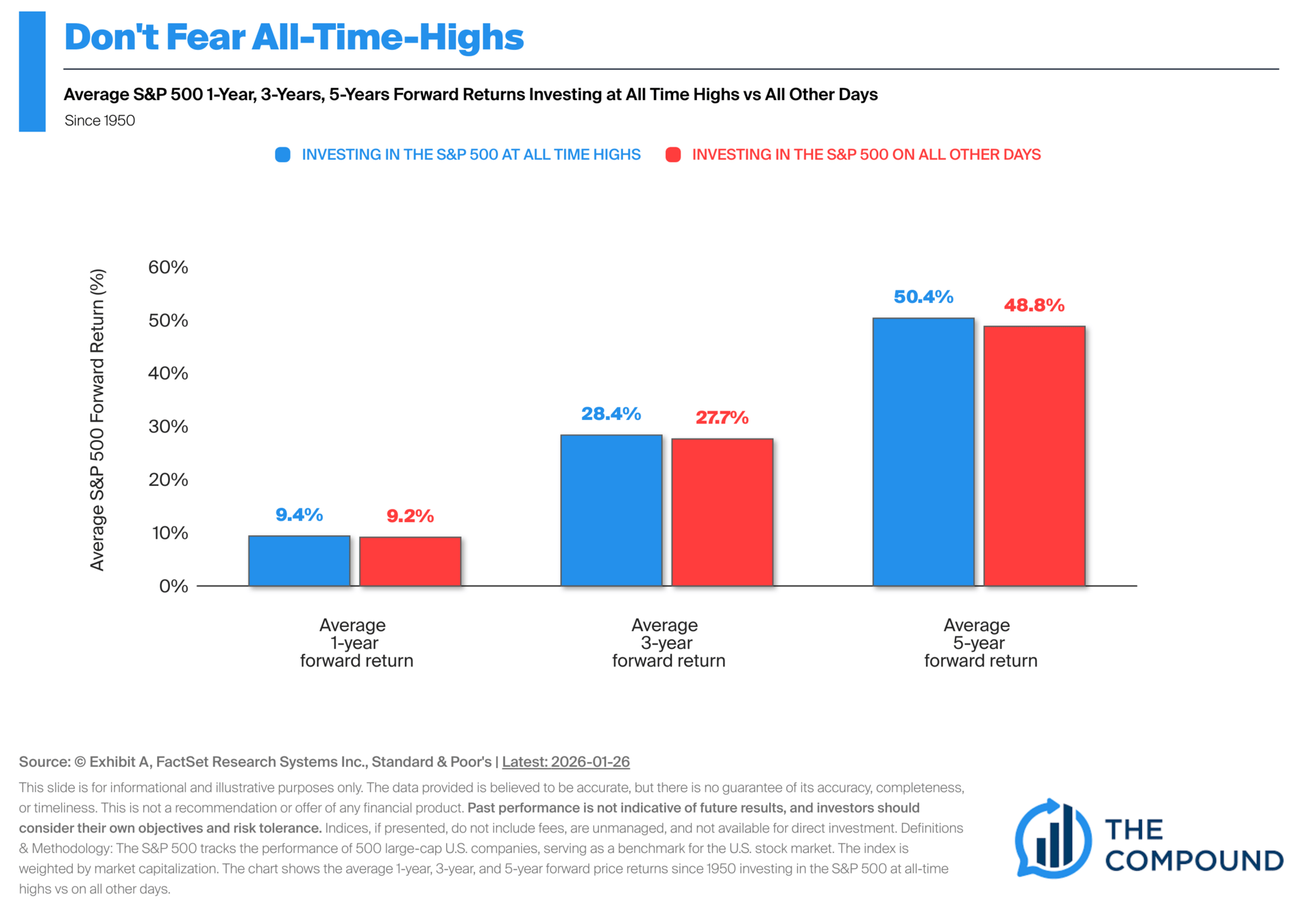

The chart below shows this.

Still, the data will only ever be “just the data” and the voice will keep us focused on the potential negatives even if those negatives don’t even exist yet.

They could be completely made up, fabricated, overstated, and yet we still listen.

I know this because even today (at all time highs), only 38% of people expect stock prices to be higher one year from now.

That means 62% expect stock prices to fall over the next year. They listened to the voice inside their head.

Here’s the good news:

While we are all forced to listen to the voice, we are not required to act on what it is telling us to do.

That is what makes investing is so difficult.

Every day the market is open, we have to make the difficult decision of doing nothing while the voice inside our heads urges us to take action.

It is, in my estimation, the hardest part about investing.

Do your best to ignore it. You (and your wallet) will thank me later.

That’s all for today. Thank you, as always, for reading!