Advertisement

Anthropic or xAI IPO in 2026? AGIX ETF Offers Exposure

Anthropic and xAI may be edging closer to the public markets. Click to read how IPO speculation is building and how investors can access both these private AI leaders today through KraneShares AGIX ETF.

Payrolls came in hot this morning on a strong headline beat (+130k actual vs +65k expected).

The gain in payrolls was driven by Education & Health Services, which contributed +137k. The second strongest industry gained only +34k (Professional & Business Services).

Here’s a breakdown of the report by industry group:

This is now the 18th payrolls report in a row that the Education & Health Services Industry led job gains.

Quite the run for teachers, nurses, and the broader education/healthcare workforce. I dig it.

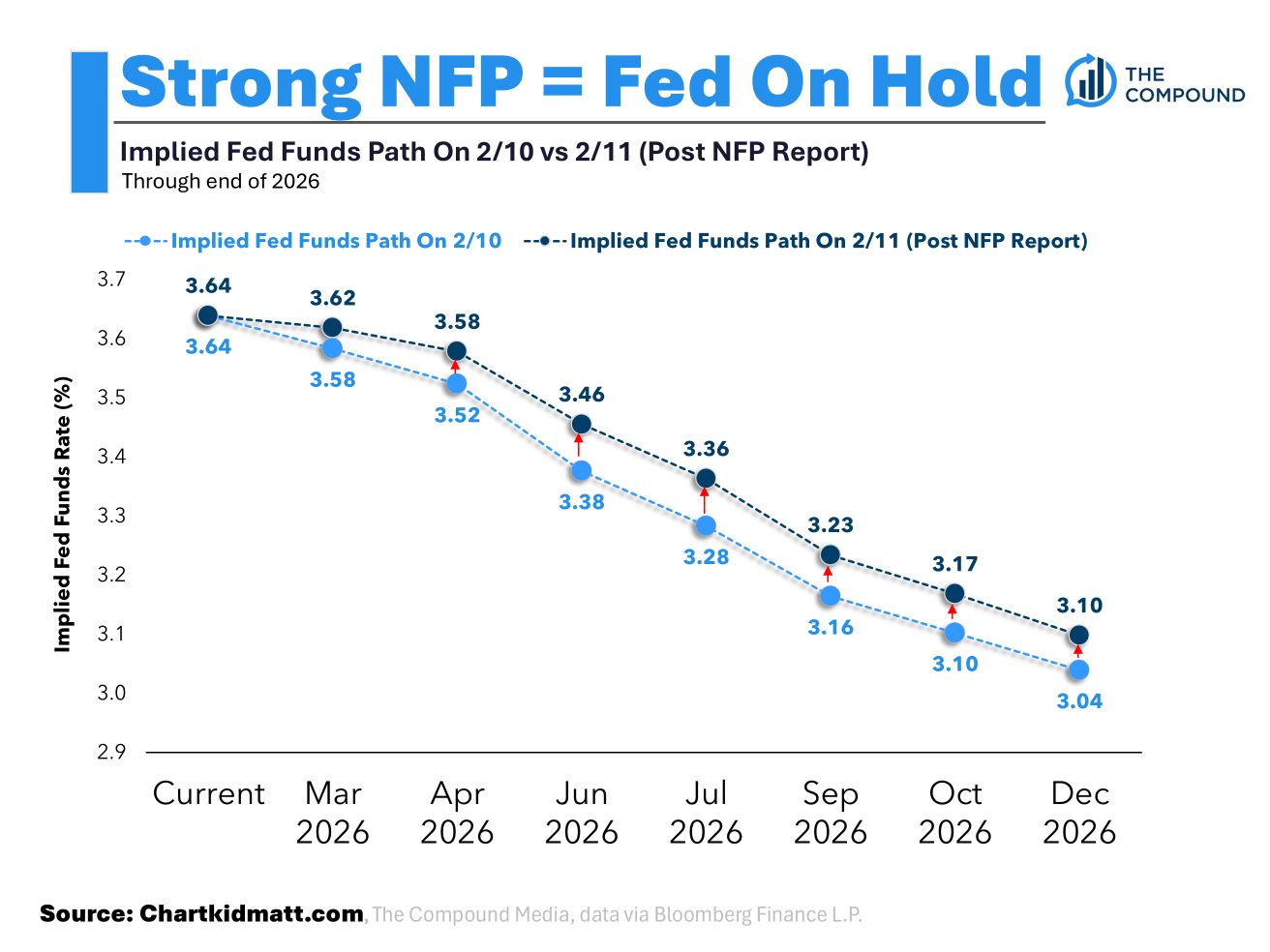

Fed Fund Futures initially took the report as “hawkish” with the # of cuts expected in 2026 falling from 2.35 pre report to 1.99 post report.

The initial reaction seems to be exaggerated, however, as the # of rate cuts expected in 2026 has been creeping higher after the initial downward reaction.

Below I've plotted the Implied Fed Funds Path as priced in by futures pre NFP report (light blue line) vs post NFP report (dark blue line).

See the shift higher in Fed Funds Rate expectations across the curve?

It shows that the outcome of the NFP report has still created a “fed on hold” vs a “fed ready to ease.”

In other words, the labor market still isn’t giving the Fed a reason to rush.

I haven’t written any economic commentary in a while so consider this my way of scratching the “macro strategy” itch (ew, I didn’t like the way that came out).

If you want to see more of this, shoot me a note by replying to this email.

Otherwise, I plan to going back to the whole “one face-blowing chart” structure that I typically post.

That’s all for today. Thank you, as always, for reading!