Advertisement

Agricultural Commodities: Rooted in Resilience

Corn, soybeans, wheat, and sugar prices have historically contributed to positive real returns during inflationary periods. Explore Agricultural Commodity ETFs.

In 1966, Abraham Maslow wrote the following:

“I suppose it is tempting, if the only tool you have is a hammer, to treat everything as if it were a nail.”

This phenomenon is formally known as Maslow’s Hammer, a cognitive bias stating that people tend to over rely on a familiar tool, method, or framework, and in doing so apply it broadly even when it is not the most appropriate solution.

In my view, there’s a lot of that going on in the market today.

Here’s what I mean:

Investors in 2025 are equipped with one historical “precedent” to draw comparisons to: the 2000 Tech Bubble.

And just as Maslow warned nearly 60 years ago, the overreliance of the Tech Bubble as today’s historical analog has created an environment where investors are carrying 2025 “AI Bubble Hammers” looking for 2000 “Tech Bubble Nails.”

I’m not trying to be dismissive of their concerns.

But going through the data, I’m just having trouble finding these nails.

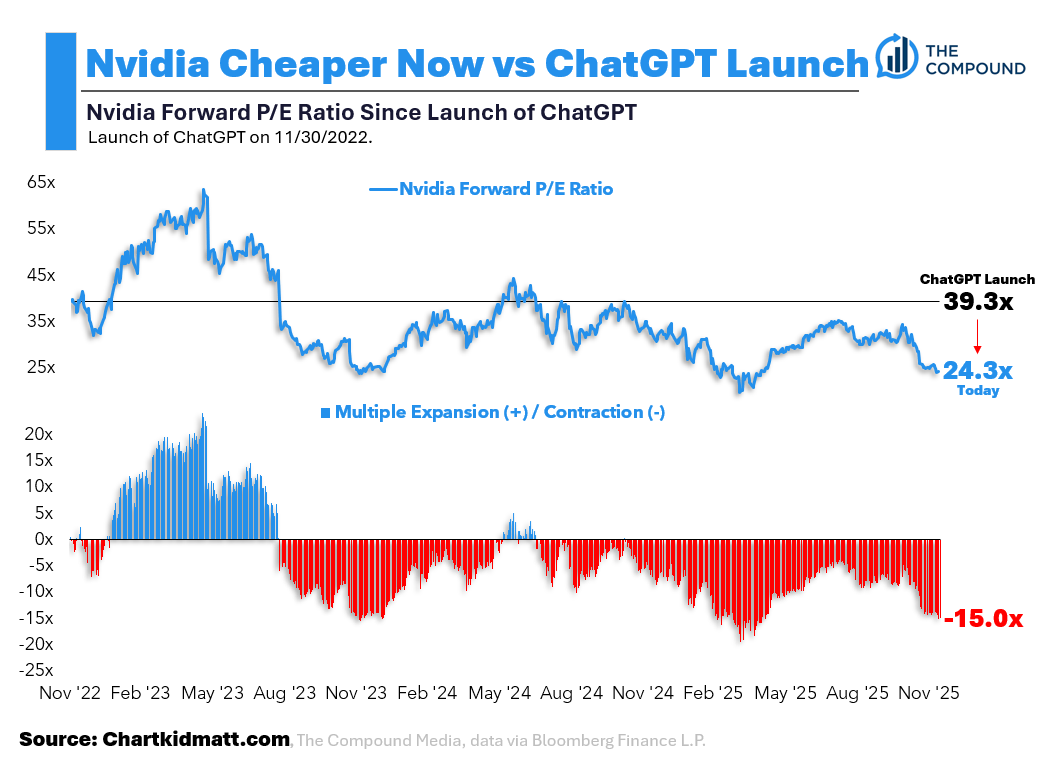

For example, Nvidia’s Forward P/E ratio has fallen 15 points since the launch of ChatGPT.

The stock has 10x’ed over this period which means all of the gain in share price can be attributed to the “E” in the forward P/E moving higher.

That’s fundamental improvement, not rampant speculation.

I’ll put my hammer down.

Here’s another one. Nvidia currently has a “bearish” sentiment score on Stocktwits.

The sentiment score measures whether most users posting on a symbol over the last 24 hours are bearish or bullish. I’m writing this on 12/22, so the data is current.

Again, the stock is up 10x in the past three years, but most investors are pessimistic on the name.

Isn’t that the opposite of euphoria?

Last one.

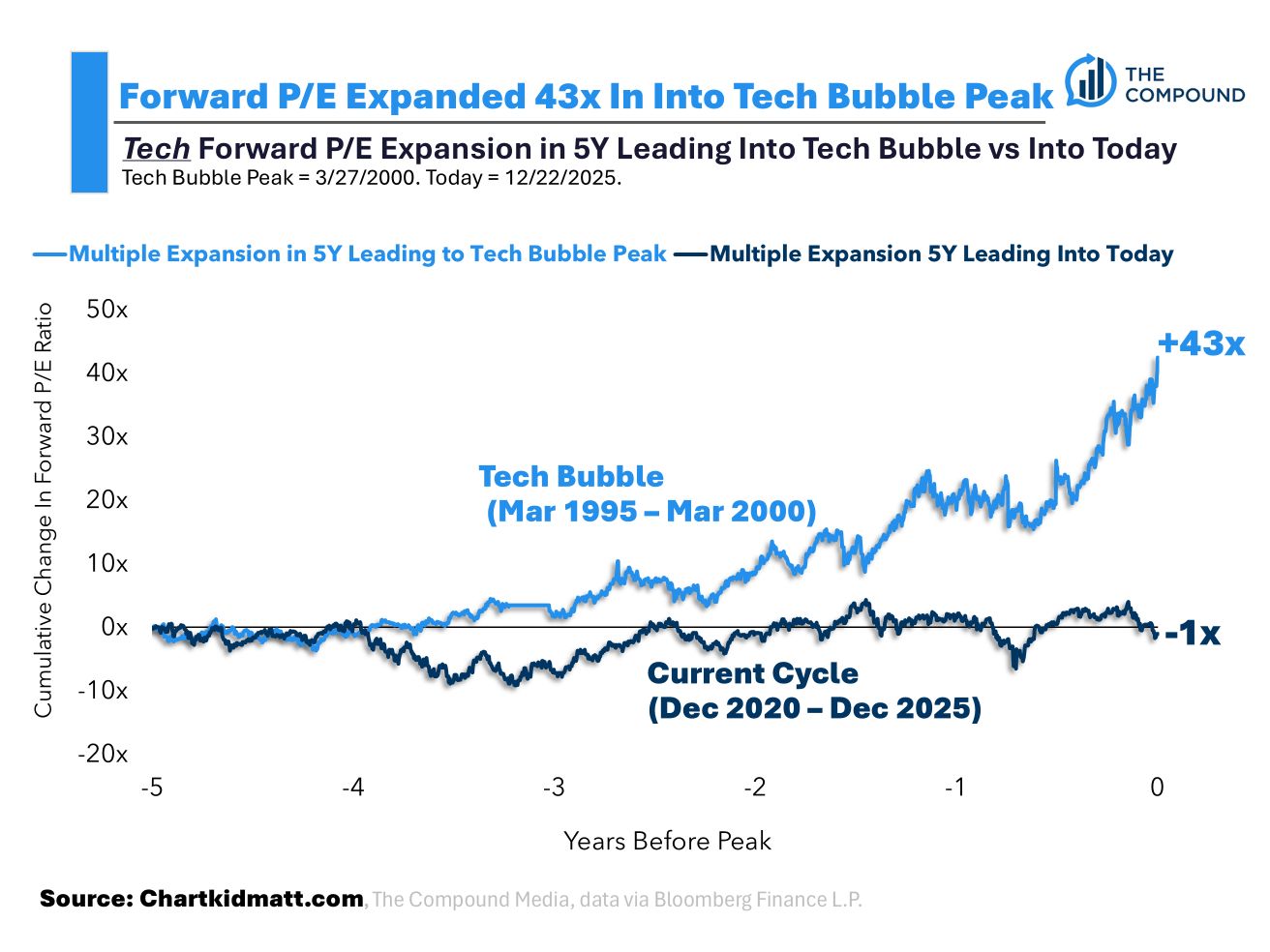

In the five years leading into the Tech Bubble peak, the forward P/E on the S&P 500 Tech Sector increased by 43x. In the past five years it has fallen -1x.

Does this mean we are immune to drawdowns over the next 12 months?

Absolutely not. We may see a vicious bear market. I have no idea.

But if we are going to make claims about bubbles, the burden of proof should come from the data.

And in my observations, the valuation, sentiment, and fundamental “nails” of today look very different from those of 2000.

Happy holidays to all and as always, thank you as always for reading!

Financial Advisors: if you are interested in my charts in your brand, check out Exhibit A.

You can also book a demo with me here.

Sidenote: I first learned the concept of Maslow’s Hammer working at Fundstrat. Tom and the team produce great research. You can check them out here.