Another earnings season, another reminder to never doubt Corporate America.

Here’s some eye-popping stats:

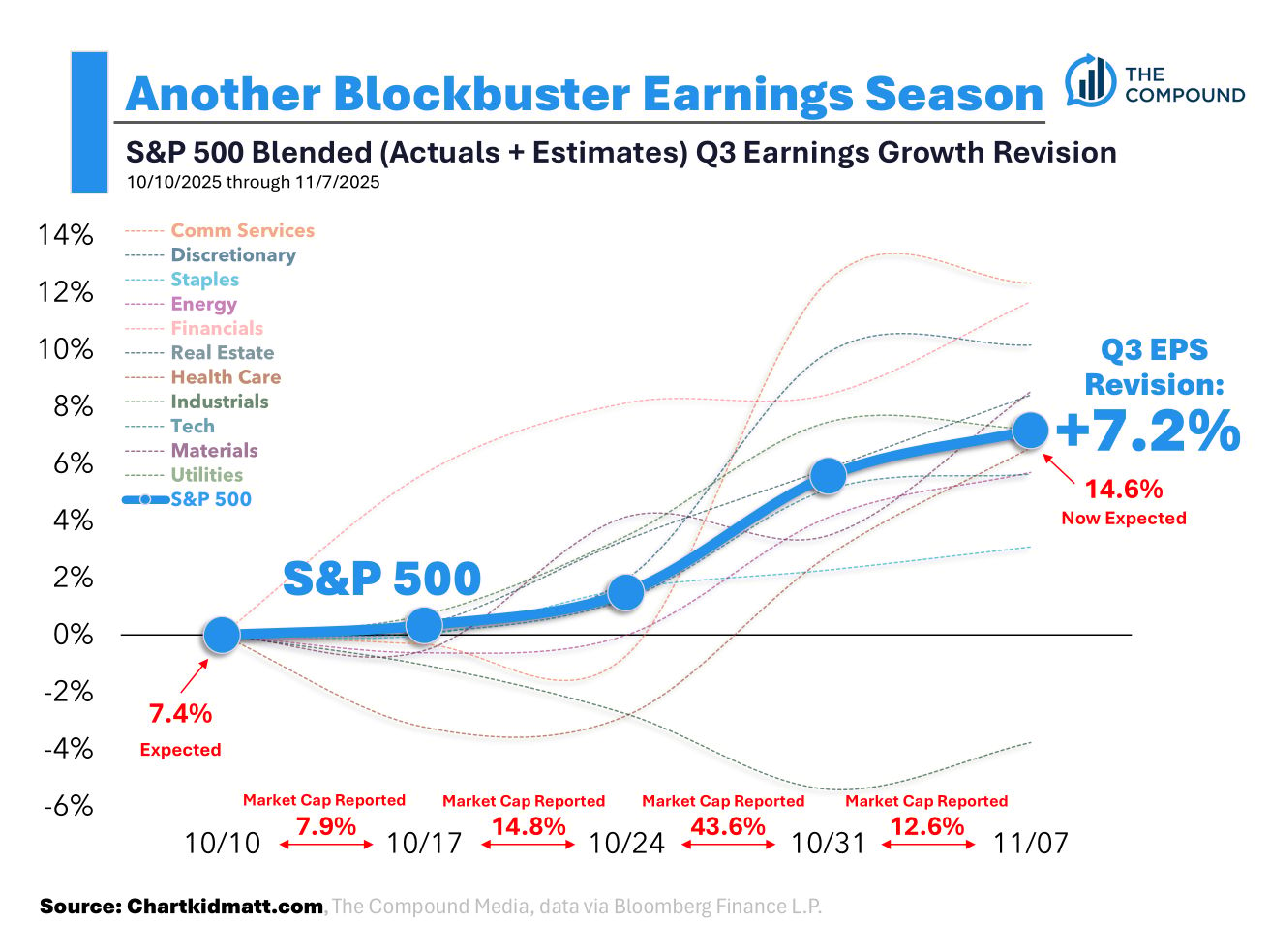

90% of the S&P 500’s market cap has reported and analysts expect S&P 500 profits will now grow 14.6% year-over-year in Q3.

The estimate heading into earnings season was for 7.4% growth, so we are beating the preseason estimate by an additional 7.2%.

Said differently, S&P 500 companies are growing profits at nearly double the rate they were expected to.

Unreal.

Let me visualize this for you guys. Take a look below.

10 out of 11 sectors have seen upward revisions to their Q3 earnings growth. The only sector with a downward revision is Industrials.

At the index level, the S&P 500’s blended earnings growth has been revised up by 7.2%, now tracking +14.6% vs the original +7.4% preseason estimate.

Oh, and by the way, the Mag7 cumulatively now make $1M a minute.

Crazy stuff.

That’s all for today. Thank you for reading and have a great week!